Buy Verified Wise Accounts

Are you looking for Buy Verified Wise Accounts for your business? Then, you have hit the right place. We can provide you with 100% fully Verified Wise Accounts at a very reasonable price. If you are interested, about more information just knock US : ➤

Buy Verified Wise Accounts

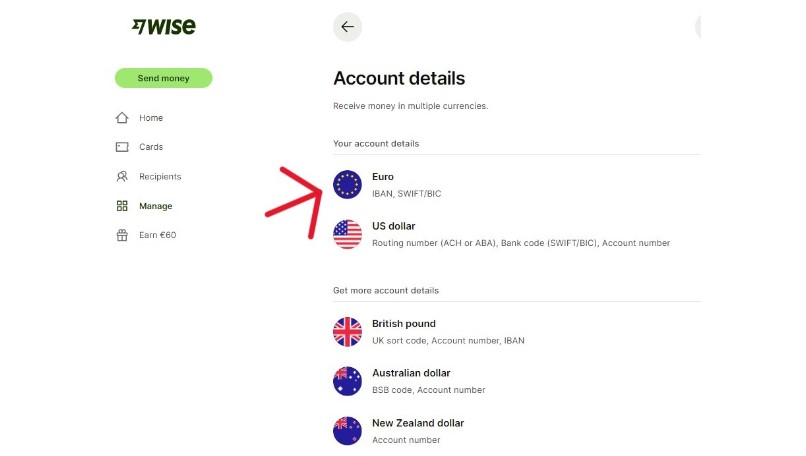

Wise offers online accounts that allow users to hold and manage multiple currencies, make international money transfers, and receive payments from around the world, all at competitive exchange rates. Wise accounts are user-friendly and provide an easy way for individuals and businesses to handle their international financial transactions efficiently.

International money transfers and currency conversions can often be costly and complex. However, with the advent of online banking and digital platforms, innovative solutions have emerged to simplify these processes. One such solution is offered by wise, a renowned company providing online accounts that cater to the needs of individuals and businesses alike.

These accounts allow users to hold and manage multiple currencies, facilitating international money transfers and receiving payments in a hassle-free manner. With competitive exchange rates, transferwise accounts have become an increasingly popular choice for anyone seeking a cost-effective and convenient method for handling their international financial transactions. We will explore the various features and benefits of transferwise accounts and how they are transforming the way people manage their global finances.

Understanding Transferwise Accounts

transferwise accounts play a crucial role in international money transfers, offering numerous benefits and features. These accounts enable individuals and businesses to send and receive money at a lower cost compared to traditional bank transfers. With transferwise accounts, you can hold and manage multiple currencies, making it convenient for those who frequently deal with different currencies.

Another advantage is the transparency of fees, as transferwise provides real-time exchange rates and low transfer fees. Additionally, transferwise accounts are user-friendly, with a user-friendly interface and easy-to-navigate website and mobile app. Moreover, the security measures in place ensure that your money and personal information are protected.

So, if you are planning to make international transfers, consider using transferwise accounts for a seamless and cost-effective experience.

How To Create A Transferwise Account

Creating a transferwise account is a simple process that requires a few key steps. To start, gather the necessary documentation for account setup. This typically includes a valid id, proof of address, and sometimes additional identity verification. Once you have your documents ready, visit the transferwise website or download the mobile app.

From there, you can easily sign up and provide the required information such as your name, email, and password. Remember to choose the account type that suits your needs, whether it’s a personal or business account. After entering your details, transferwise may prompt you to verify your identity.

This can be done through a photo id upload or by using their video verification feature. Once your identity is verified, your transferwise account will be created and ready to use for quick and affordable international money transfers.

Funding Options For Transferwise Accounts

Funding options for transferwise accounts include various methods for depositing funds. One of the popular methods is integrating bank accounts with transferwise accounts. This allows users to transfer money seamlessly between their bank accounts and transferwise accounts. By linking their bank accounts, users can easily deposit funds into their transferwise accounts whenever they need to.

This integration eliminates the hassle of manual transfers and ensures that funds are readily available for currency exchanges or international transfers. Whether it’s for personal or business purposes, integrating bank accounts with transferwise accounts offers a convenient and efficient way to manage funds.

With this option, users can take advantage of the competitive exchange rates and low fees offered by transferwise while enjoying the simplicity of transferring funds directly from their bank accounts.

Managing Transferwise Accounts

Transferwise accounts can be managed easily through the intuitive dashboard. Navigating the dashboard allows users to transfer funds and make payments seamlessly. The transferwise account dashboard provides a user-friendly interface, enabling users to view and manage their account balance, transactions, and currency exchange rates.

It also allows users to set up recurring payments and manage payment recipients. The dashboard provides real-time updates on the status of transfers and payments, ensuring transparency and peace of mind. With a few clicks, users can initiate transfers, add new recipients, and review transaction history.

Managing transferwise accounts has never been more efficient and convenient. Simplify your financial transactions by utilizing the powerful features of the transferwise account dashboard.

Transferwise Account Fees And Charges

Transferwise accounts offer an excellent way to manage your finances without hefty fees. By understanding the associated fees and charges, you can optimize your account usage. One important aspect to consider is currency conversion rates. These rates can impact the amount you receive when converting funds.

It is crucial to be aware of any additional fees that may be imposed during this process. By staying informed and making strategic decisions, you can minimize unnecessary expenses and maximize the value from your transferwise account. With a user-friendly interface and competitive rates, transferwise provides a convenient and cost-effective solution for international money transfers.

Enhancing Security For Transferwise Accounts

Enhancing the security of your transferwise account is crucial to protect your finances. Two-factor authentication is an effective way to add an extra layer of security to your account. By enabling this feature, you ensure that a password alone is not enough to access your funds.

When logging in, you will need to provide a second piece of information, such as a unique code sent to your mobile device. This verification process significantly reduces the risk of unauthorized access. In addition to two-factor authentication, there are other measures you can take to secure your transferwise account.

Regularly updating your password and using a strong and unique password are essential steps. It is also advisable to enable notifications for account activities, allowing you to stay informed about any suspicious actions. By following these tips, you can enhance the security of your transferwise account and have peace of mind knowing your funds are well-protected.

Transferwise Account Limits And Restrictions

Transferwise account limits and restrictions vary depending on the country. It is important to understand these limitations for smooth transactions. Different countries impose different restrictions on transferwise accounts. By knowing the restrictions in your country, you can avoid any hindrances in your transactions.

Transferwise has set specific limits on the amount of money you can send, receive, and hold in your account. These limits may vary based on factors such as verification status and account type. It is advisable to verify your account to access higher limits.

Additionally, certain restrictions may apply to specific types of transactions such as business payments or currency conversions. It is crucial to be aware of these limitations to ensure hassle-free transactions through your transferwise account

Transferwise Accounts For Businesses

Transferwise accounts provide numerous benefits for businesses. These accounts make international transactions easier and more cost-effective. With transferwise, businesses can save on currency conversion fees and enjoy competitive exchange rates. Setting up a transferwise account for business use is a straightforward process.

This feature ensures easier money management for businesses operating internationally. Additionally, transferwise provides tools and integrations that can streamline financial workflows, making it a convenient solution for businesses of all sizes. Overall, transferwise accounts offer a reliable and efficient way for businesses to handle their international transactions.

Frequently Asked Questions About Transferwise Accounts

Transferwise accounts are widely used for international money transfers. If you have questions about these accounts, this blog post will provide answers. Many queries arise regarding transferwise accounts, and we aim to address the most common ones. Wondering how to troubleshoot issues with your transferwise account?

Look no further. We have compiled a list of tips to help you resolve any account-related problems. Whether you have concerns about fees, security, or how to verify your account, we’ve got you covered. Our goal is to provide you with clear and concise information to ensure you have a seamless experience with transferwise.

What Are Transferwise Accounts?

Transferwise accounts are online financial accounts that allow you to send, receive, and hold money in multiple currencies. They offer competitive exchange rates and low fees, making it convenient and cost-effective for international transactions.

How Do I Open A Transferwise Account?

To open a transferwise account, simply visit their website or download their mobile app. Fill in your personal details, provide the necessary identification documents, and follow the instructions to verify your identity. Once verified, you can start using your transferwise account.

What Currencies Can I Hold In My Transferwise Account?

Transferwise accounts allow you to hold over 40 different currencies, including popular ones like usd, eur, gbp, aud, and jpy. This allows you to conveniently manage your money in various currencies and avoid expensive currency conversion fees.

Can I Use Transferwise Accounts For Business Purposes?

Yes, transferwise accounts are suitable for both personal and business use. They offer separate account types for individuals and businesses, allowing you to easily manage your finances and make international payments for your business activities.

Are Transferwise Accounts Safe And Secure?

Transferwise accounts prioritize the safety and security of your money. They are regulated by relevant authorities and employ robust security measures, such as two-factor authentication and encryption technology, to protect your account and transactions. Your funds are also held in trusted financial institutions.

Conclusion

Transferwise accounts offer a secure and convenient solution for individuals and businesses looking to send and receive money internationally. With their competitive exchange rates and low fees, users can save significant amounts of money compared to traditional banks. The user-friendly interface and seamless experience make it easy to navigate the platform.

Sharon P. Jones –

This is the best website where I buy a lot of services from here. I recommend to everyone. thanks

Thomas Beiganz –

Impressive service for obtaining a Verified Wise Accounts. The account provided was legitimate and met all my requirements. A reliable and trustworthy platform to buy from.